Granny Flat Finance Broker

We're your local granny flat finance broker- and we can assist you with financing for building or buying a granny flat. As local mortgage brokers who deal with tiny home buyers and builders, we're experts at getting fantastic deals for people borrowing money to own a granny flat.

Do you need help to arrange a loan or borrow money to build a granny flat at home? Our granny flat finance broker team has access to a huge range of local and national lenders. this means you can get a far better rate with no fees to you. The same lenders who our tiny home finance specialists work with, also provide loans for granny flat.

Reimagining the Great Australian Dream: Why Granny Flats Are the Future of Housing – And How Granny Flat Finance Brokers Can Help You Finance One

And not just any granny flat.

We're talking modern, custom-built secondary dwellings that add value, provide housing solutions, and open the door to new financial opportunities.

With property prices climbing and rental vacancies hitting record lows, homeowners are increasingly turning to granny flats as a smart, long-term solution. Whether it's to house adult children, elderly parents, or paying tenants, granny flats are playing a vital role in easing Australia’s housing crisis—and as mortgage brokers specialising in granny flat finance, we’re here to help you make it happen.

The Rise of the Granny Flat

As one granny flat finance broker said recently:

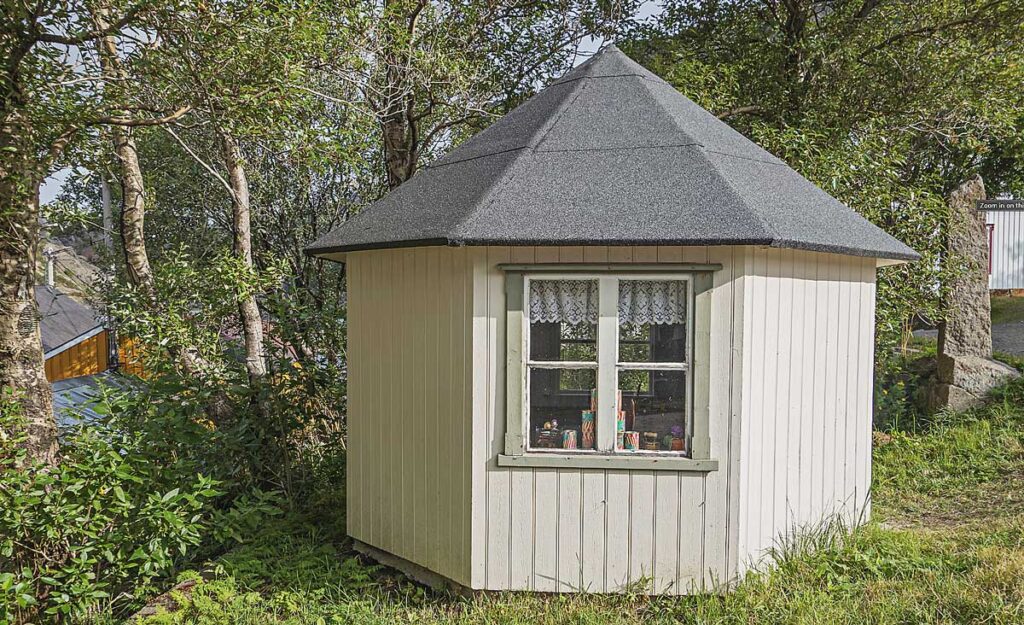

“Granny flats have come a long way from the modest little units tucked away at the back of a suburban block”.

Today’s builds are sleek, self-contained homes with modern kitchens, stylish bathrooms, and open living areas. And the demand is booming. In fact, new data shows that more than 650,000 properties across Australia’s major cities have the potential to add a two-bedroom granny flat. That’s goes a long way to helping with the goal of building 1.2 million by mid 2029.

Why? Because they’re relatively quick to build, cost-effective, and offer flexible living arrangements in a time where affordability is front of mind. Plus, states like Victoria and Queensland are slashing red tape. In Victoria, for example, the need for a planning permit has been completely removed—you can now build a granny flat with just a standard building permit. It’s never been easier to get started.

Table of Contents

ToggleWho Are Granny Flats For?

Let’s bust a myth: You don’t have to be a granny to live in one. Granny flats are now housing young professionals, students, couples, and even small families. They’re perfect for:

- First-time investors looking for rental income

- Families who want to support older relatives or adult kids

- Homeowners needing to offset rising mortgage costs

- Landlords seeking high-yield secondary dwellings

- Downsizers looking for independent living on the same block

Whether it’s a lifestyle decision, an investment move, or a financial necessity, a granny flat can offer flexibility, freedom, and financial security.

More Than Just a Place to Stay

For many Australians, a granny flat is more than just extra space—it’s a strategic investment. Adding a granny flat can increase your property’s value by 10% to 20%. And if you’re planning to rent it out, you’re looking at high rental yields that could help cover your mortgage or even generate passive income.

As experienced mortgage brokers, we know how to structure granny flat loans to support your financial goals. Whether you’re refinancing to access equity, applying for a construction loan, or exploring investment property finance, we tailor the strategy to your needs.

We get it—granny flats aren’t just for grannies anymore. In fact, many are being built to support multigenerational living, provide affordable housing for adult children, or offer privacy to ageing parents while keeping them close. Others are looking to generate income in a tight rental market, with some landlords fetching almost as much rent for a premium granny flat as a standalone house.

Fast Turnaround, Big Returns

Borrowing the money you need, with the help of a granny flat finance broker will get you funds to commence building, sooner.

One of the biggest perks of building a granny flat is how fast the process can be. In many cases, a high-quality build can be completed in as little as 14 weeks from start to finish. That includes everything from site assessments, council approvals, and design customisation to the full build—including the slab, framing, roofing, interiors, tiling, and final inspections. It’s a turnkey process that transforms an underused backyard into a brand-new, livable home.

With the right granny flat finance in place, you can leverage this opportunity without dipping into your savings. Our team can connect you with lenders that understand the unique nature of secondary dwellings and offer flexible loan options to suit your budget and goals.

The Granny Flat Finance Broker Who Thinks Long-term

When it comes to financing a granny flat, we encourage clients to think beyond the upfront build cost. The real question isn’t “How much does it cost to build?” but “What’s the return on investment?” A well-designed, high-quality granny flat can command strong rental returns and increase your property’s resale value. You might be surprised to learn that premium granny flats—when built right—can attract similar rents to small houses.

But not all granny flats are created equal. Some homeowners make the mistake of choosing the cheapest option, only to find themselves with a structure that looks and feels temporary. People want to downsize—but they don’t want to downgrade. We help you structure your finances to support a high-quality build that delivers long-term returns. Speak with us- your local granny flat finance broker and fine the loan that best suits your circumstance.

A Granny Flat Finance Broker Who Knows the Mortgage Market

As specialists in granny flat loans, we take the stress out of the finance process. From equity release and construction loans to investment strategies and refinancing, we’ll help you understand all your options and guide you every step of the way.

Need to tap into your home equity?

We can help.

Looking for a fixed-price construction loan?

We’ve got options.

Unsure whether you qualify for council approval?

We’ll walk you through the process.

Want to compare lenders?

We’ll do the legwork for you.

A Mortgage Broker Who Knows Granny Flat Finance

As specialists in granny flat loans, we take the stress out of the finance process. From equity release and construction loans to investment strategies and refinancing, we’ll help you understand all your options and guide you every step of the way.

- Need to tap into your home equity? We can help.

- Looking for a fixed-price construction loan? We’ve got options.

- Unsure whether you qualify for council approval? We’ll walk you through the process—or connect you with the right experts.

- Want to compare lenders? We’ll do the legwork for you.

Every build is different. Every property is unique. And every client’s financial situation deserves a custom strategy. We’re not just here to write a loan—we’re here to help you grow your property’s value, generate income, and plan for the future.

What Lenders Look for (And What They Don’t Tell You)

Let’s talk straight: not all lenders treat granny flats and secondary dwellings equally. Some won’t lend unless the granny flat is attached to the main home. Others will ignore the rental income when assessing your borrowing capacity. Some won’t touch modular or kit homes at all.

That’s where our role as your dedicated granny flat mortgage broker becomes crucial. We know which lenders accept what. We know who will factor in projected rent, who’ll allow equity release for the build, and which lenders are flexible with non-standard dwelling types.

This knowledge could mean the difference between a declined application and a well-structured loan that helps you move forward. It’s also why working with a broker who understands granny flat finance is so important—you’re not just looking for “a loan,” you’re looking for the right loan with the right terms.

Not Just Granny Flats: Financing All Kinds of Small-Scale Living

While granny flats are leading the charge, there’s a whole movement emerging around compact, secondary dwellings—tiny homes, modular homes, and kit homes are all part of this evolving housing landscape. As a mortgage broker with a strong focus on small dwelling finance, we’re seeing more and more clients exploring these options not only for affordability but for flexibility, speed of build, and lifestyle benefits.

Whether you’re considering a granny flat or looking into a transportable modular build, there’s a growing need for specialised finance solutions. Traditional lenders often don’t know how to assess these builds properly—but we do.

As your tiny home mortgage broker or modular home mortgage broker, our job is to connect you with lenders who understand the nuances. That means knowing which banks will lend on prefabricated structures, who accepts owner-builder loans, and how to work with limited land titles or unusual zoning requirements. These things matter, and they can make or break your application

Kit Homes, Modular Builds, and Finance That Fits

Kit homes and modular builds are gaining traction fast—and for good reason. They’re cost-effective, pre-engineered, and can often be installed in weeks rather than months. But just like with granny flats, the finance side is rarely straightforward.

We help clients navigate the specific challenges of kit home finance—like staged progress payments, fixed-price contracts, and valuation issues. As your kit home mortgage broker, we’ll guide you through everything from pre-approval to post-build handover, making sure every piece is in place.

And if you’re considering a modular home for a regional or off-grid location? We can help with that too. Some lenders shy away from alternative builds in non-metro areas, but we work with banks and specialist lenders who understand the value and viability of these structures.

Why Smaller Homes Make Bigger Sense Right Now

Affordability isn’t just a buzzword—it’s a real challenge. Rental demand has surged, wages haven’t kept pace with inflation, and interest rate hikes have made it tougher for families and first-time buyers to get ahead. This is where small dwellings shine.

Granny flats, tiny homes, and modular builds are often more energy-efficient, easier to maintain, and far more cost-effective to construct. The shorter build times mean you’re not sitting around waiting for tradies or battling supply chain delays. With the right approvals in place, you could go from backyard to turnkey rental property in just a few months.

We’re also seeing homeowners across Victoria, Queensland, and the ACT fast-tracking these projects thanks to relaxed council laws. In some areas, you don’t even need a planning permit anymore—just a standard building permit. That alone can save weeks or months of admin and cost.

So whether you’re building to house a loved one, accommodate a renter, or add value to your investment property, this approach is worth exploring. And with us as your granny flat mortgage broker (or kit home mortgage broker), we’ll make sure the finance side of things doesn’t hold you back.

The Human Side of the Housing Crisis

It’s easy to talk about housing from an economic point of view—rents, yields, valuations, ROI—but there’s also a very real, very personal side to this. As seen in one case shared in the media, a man named Mike, aged 44, found himself living in his mother’s spare room after struggling to find a rental. Competing with 50 applicants every time a listing came up, he eventually moved into a one-bedroom granny flat his mum helped build.

This story, unfortunately, isn’t unique. We’re hearing more about adult children moving back home, retirees struggling with rising rent, and older Australians searching for secure, low-maintenance homes. That’s the reality for many right now—and it’s driving demand for flexible living solutions like granny flats and modular homes.

As mortgage brokers, we have the privilege of helping people make these transitions with dignity and independence. Whether you’re financing a build for a loved one or yourself, we’re here to make the process approachable, compassionate, and tailored to your needs.

Planning for Now—And for What Comes Next

It’s not just about today. Financing a granny flat or a tiny home can have long-term financial benefits, especially if you’re thinking ahead. Want to create a future Airbnb? Planning to subdivide later? Hoping to use the property to support your retirement income?

The good news is, with the right finance structure, you can future-proof your investment. Whether you’re buying, building, or refinancing, we look at the whole picture to make sure your lending aligns with your plans—not just for now, but five or ten years down the track.

We’ve helped homeowners finance multi-generational living setups, short-term rental dwellings, backyard studios, and even dual-income properties—all with tailored lending that suits their goals.

Let’s Get Started

At the end of the day, a granny flat isn’t just an add-on—it’s a smart financial move. And with the right mortgage broker by your side, navigating granny flat finance doesn’t have to be complicated.

If you’re ready to explore your options, we’re ready to help. Let’s talk about how a custom loan solution can help you build, invest, and create a future-ready property.

Whether you’re starting from scratch or just need guidance on financing a granny flat build, we’re here to guide you from concept to completion.

Getting a Loan to Buy a Tiny Home – How We Help:

With a tiny home finance specialist in your corner, you won’t waste time chasing lenders who don’t understand the tiny home movement. Instead, we’ll find the best financing solution for your needs, so you can focus on the exciting part—bringing your tiny home vision to life!

Assess Your Borrowing Capacity

We help you determine how much you can borrow based on your income and financial situation.

Find Lenders Who Understand Tiny Home Financing

Access loan options specifically designed for tiny homes on wheels, fixed dwellings, or off-grid setups.

Secure the Best Loan Structure

We match you with the right loan type, whether it’s a personal loan, chattel loan, or secured loan.

Navigate the Loan Application Process

We simplify the paperwork and approval process to make securing your tiny home loan stress-free.

Beyond the Build: Making Your Granny Flat Work Harder for You

Insure It Like the Asset It Is

Think Tax Before the Slab Is Poured

Build Green, Borrow Cheaper

Sustainability isn’t just a warm and fuzzy marketing line; it can shave real basis points off your loan. Many prefabricated granny flats already clock in at seven stars, but add a 6.6kilowatt solar array, a slimline rainwater tank plumbed to the laundry and low E glazing and you edge toward net zero living. Some banks now reward that with “green loan” discounts(1) of up to 0.20 percentage points. Given that a premium build can lift parent property value by twenty to thirty percent, a modest extra spend on ecospecs is money well placed. A granny flat finance specialist can help you source lenders that reward these energy-smart choices.

Smart Tech, Big Appeal

Short Stay Dreams versus Long Term Reality

Map Your Exit While Enthusiasm Is High

Looking Ahead: Ride the Next Wave with a Broker Who Sticks Around

Modular home finance helps you move down the road to ownership sooner. Getting finance approved for a modular house construction or purchase, is one of the smartest ways to secure affordable, energy-efficient housing. However getting the right financing isn’t always straightforward. That’s where we come in. As experienced modular home mortgage brokers, we connect you with lenders who understand modular housing and offer loans tailored to your needs. Instead of navigating complicated loan applications and rigid bank policies alone, we negotiate on your behalf to secure competitive interest rates and flexible loan terms. modular home finance- negotiated by a broker who is on your side, makes ownership faster, easier, and more affordable. Whether you’re buying a pre-built modular home, building one from scratch, or financing both land and home together, we’ll match you with the best lender to fit your situation.

Speak with our modular home finance experts and see how we can help you.